Cashing out a life insurance policy is the process by which policyholders are able to access money from their policies early. Generally, the purpose of life insurance is to provide a death benefit cash amount to beneficiaries upon the policyholder’s passing. However, cashing out on a policy early allows the policyholder themself to be able to.. Surrender. Surrendering your policy means to cash out of a life insurance policy completely. In return, you’ll get the surrender value of the cash value of your policy. However, you won’t have.

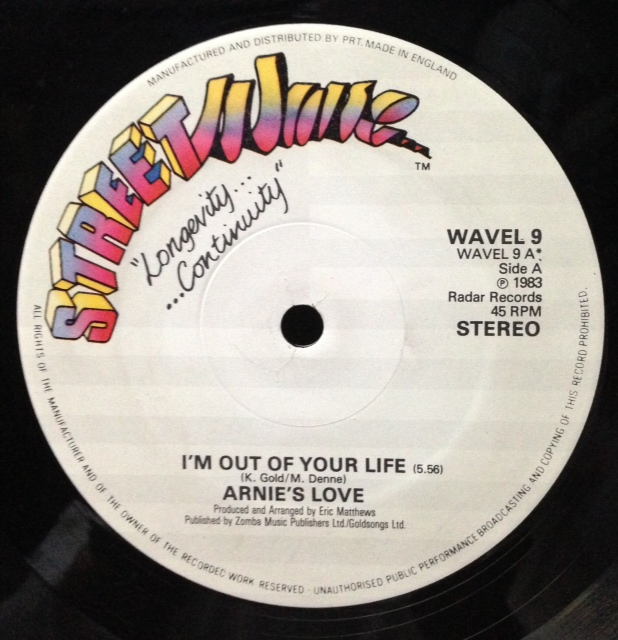

When they want to walk out your life let them go By Kirksey Roger

Life purpose, Purpose pictures, Life

7 Reasons People Come and Go Out of Your Life LetterPile

8 Easy Ways To Sort Your Life Out In 2015

Let’s Review Your Life Terrell Dinkins

Give Yourself Permission to Live in Rhythm007 ⋆ Renae Fieck Mommy motivation, Overwhelmed mom

If You Figure THIS OUT, Your LIFE Will CHANGE! EvanInterviews YouTube

Max Out Your Life Ed Mylett 9781641840293 Books

5 Steps To Find Out Your Life Purpose

Walk Out Your Life YouTube

How to Figure Out What to Do With Your Life, At Any Age, in Under 10 Minutes A Day! Life, Your

Crispr Cas9 Experiment Hot Sex Picture

7 reasons why you MUST have a life mission if you want to be happy Life mission, Life mission

Sort Out Your Life, PreEntrepreneurship (Follow This Template) YouTube

Know What You Want Official Site Dan Miller

“Can I Get CAS for That?” Ideas for IB Students Education

Pin on Self improvement

Find Out Your Life’s Purpose NOW!!! Infinite Wisdom for feeling Stuck + Purposeless! YouTube

SOUL BAR 847~VOL.6 September UMORE!~ Fm yokohama 84.7

Sort out your Life stock illustration. Illustration of self 99049702

Borrow Money. You can also tap the cash value through a policy loan. You won’t owe taxes for withdrawing gains this way. Plus, you’ll have the option to repay the money, whereas you can’t.. No. A policy that has a $50,000 life insurance benefit cannot be cashed in for $50,000. That amount can only be collected by your beneficiaries when you pass, provided you didn’t access any cash value. The money you will be able to cash in will depend on how much cash value the policy has built, which is almost always considerably less than.

![Down By The River Milky Chance [Frontal Roast Remix] YouTube Down By The River Milky Chance [Frontal Roast Remix] YouTube](https://i.ytimg.com/vi/e2gksjHVL0k/maxresdefault.jpg)