Bridge-To-let Loans & Bad Credit. If you’re planning on using your bridging loan to purchase a property that you want to let out, you can get a bridge-to-let agreement. This is an agreement with two products — a bridging loan and a buy-to-let mortgage — usually from the same provider. As long as you meet the lender’s buy-to-let mortgage.. A bad credit bridging loan is a type of short-term financing option designed for individuals or businesses with a poor credit history. It provides temporary funds to bridge the gap between selling an existing property and purchasing a new one. Unlike traditional loans, bad credit bridging loans are accessible to borrowers with low credit scores.

The problem of Bad credit history can be by using Installment loans

How to get a debt consolidation loan with bad credit

Bridging Loan How Does Bridging Finance Work? Syndication Cloud

How Your Bad Credit History Effects Your Chance Of Getting A Loan YouTube

A Brief Guide To Bridging Loan Finance

Quick bad credit bridging finance & loans for you Tailored Money

Bridging Loans Explained Applying for a Bridging Loan for Your UK Property Investment YouTube

What Is Bad Credit Financing? Knoepfler Chevrolet

Benefits Of Getting Bad Credit Loans Online Baron Mag

:max_bytes(150000):strip_icc()/whats-difference-between-secured-line-credit-and-unsecured-line-credit-v1-b78ddb9683b24ef2bc31743c5b3b13d2.png)

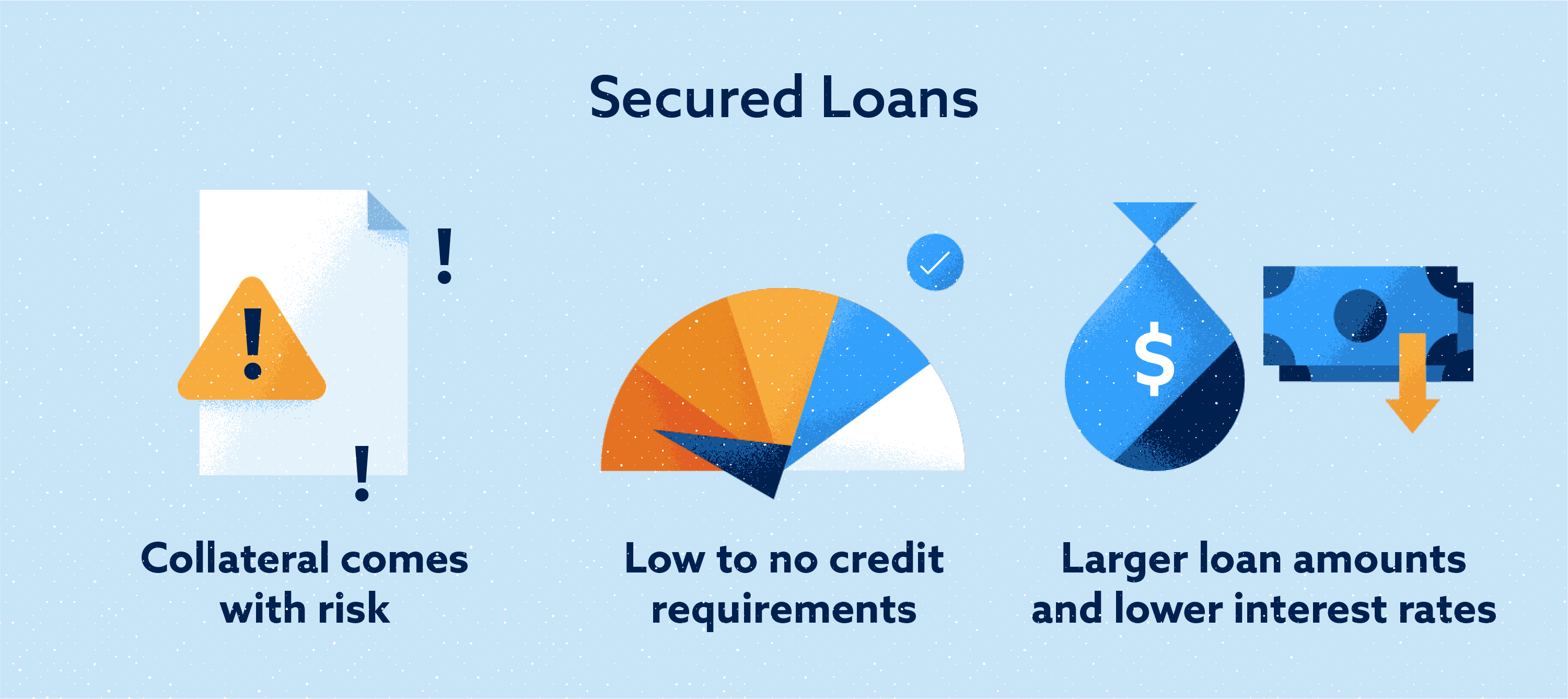

Secured Loan For People With Bad Credit History Tagamanent

How to Get a Personal Loan with Bad Credit

Bridging Loan Explained Brighten Home Loans YouTube

How to Get a Home Loan With Bad Credit 6 Steps to Take Bob Vila

Personal Loan vs Bridging Loan A Comparison Guide

How to Get a Debt Consolidation Loan with Bad Credit Debt consolidation loans, Bad credit

How Long Does It Take To Get A Bridging Loan?

Guide To What Is Bridging Loan In Singapore

Bad Credit Loans NSW Mortgage Corp Call Us 1300 138 778!

5 ways to get a loan with bad credit Lexington Law

How Bridging Loan Works And How To Apply For One

How to obtain a bridging loan with a poor credit score. If you want a bridging loan and you have a poor credit score, the first thing to do is talk to an expert advisor at Ascot Mortgages. The advisor will be able to look at your individual situation and make an initial assessment of your circumstances. You need to be honest and open about your.. Applying for a bridge loan works similar to applying for a conventional mortgage. Your loan officer will look at your credit score, credit history and debt-to-income ratio (DTI) when considering your application. Some lenders of bridge loans require a credit score of 740 or higher and a DTI below 50%, but these requirements vary by lender.