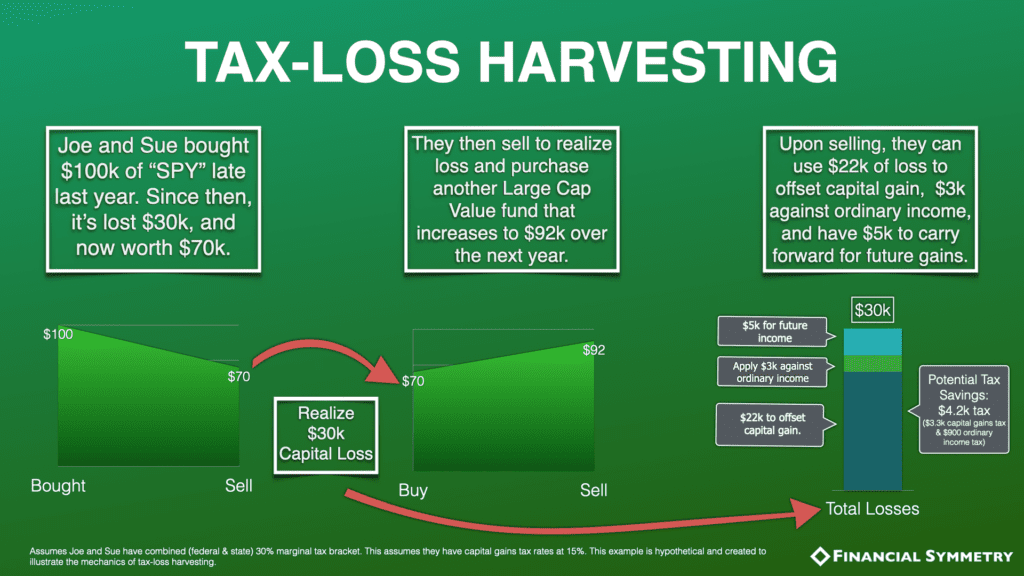

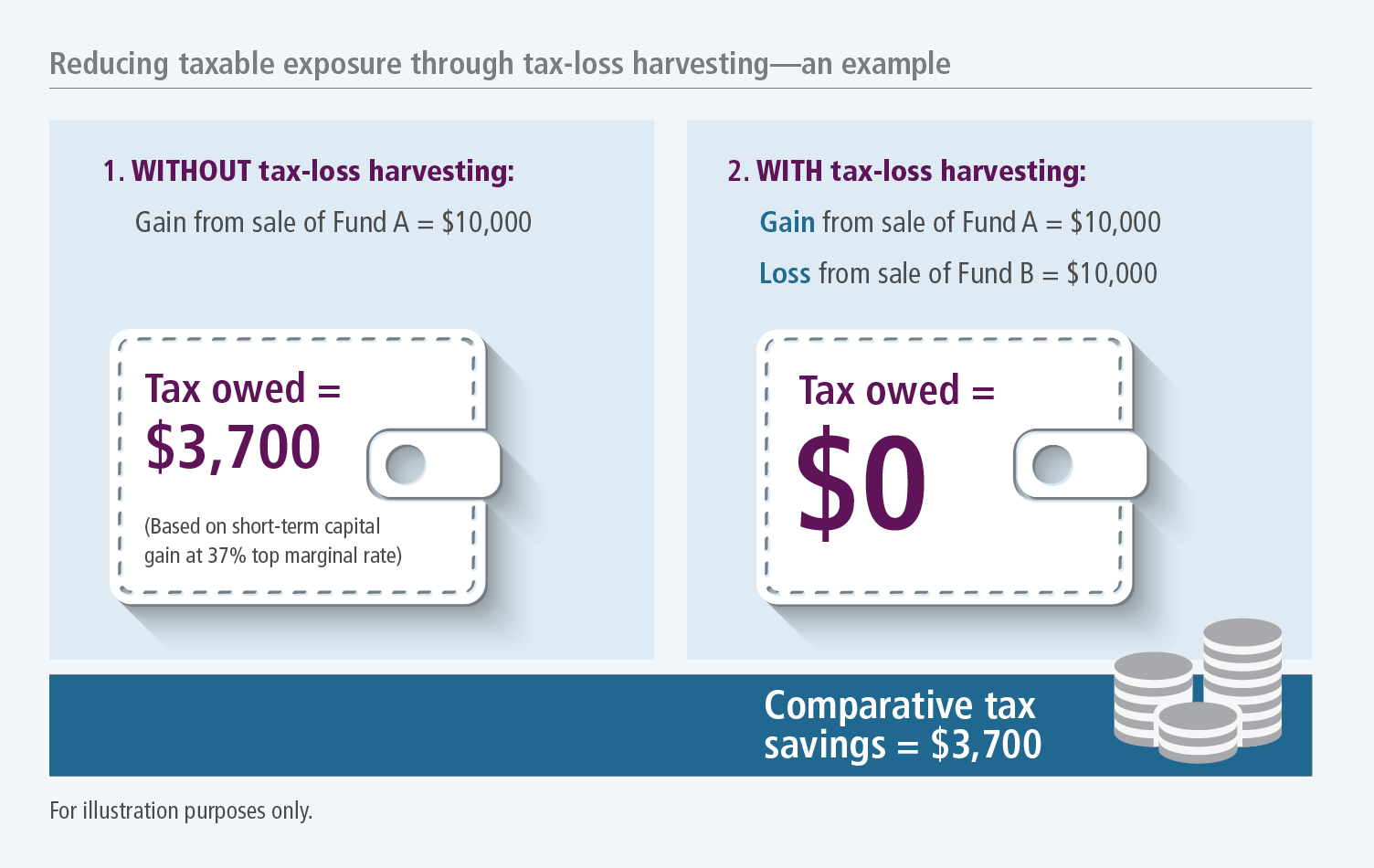

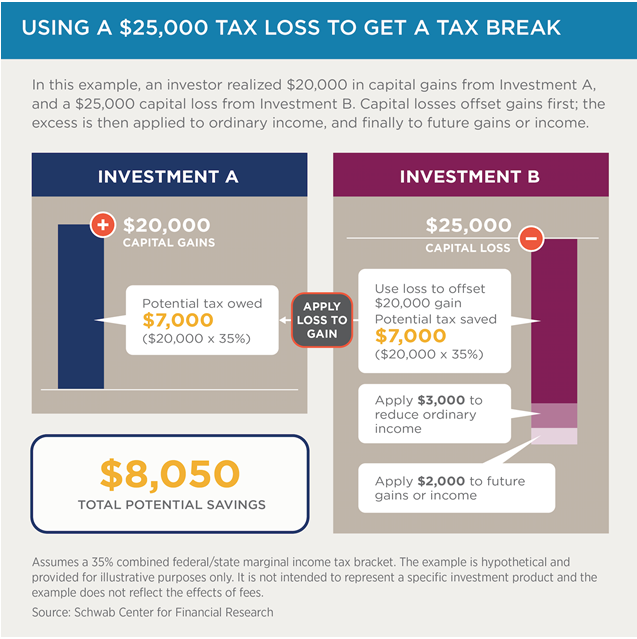

Tax gain/loss harvesting is a strategy of selling securities at a loss to offset a capital gains tax liability. It is typically used to limit the recognition of short-term capital gains, which are.. Your $25,000 loss would offset the full $20,000 gain from Investment A, meaning you’d owe no taxes on the gain, and you could use the remaining $5,000 loss to offset $3,000 of your ordinary income. The leftover $2,000 loss could then be carried forward to offset income in future tax years. Assuming you’re subject to a 35% marginal tax rate, the.

Tax Loss Harvesting Everything You Should Know

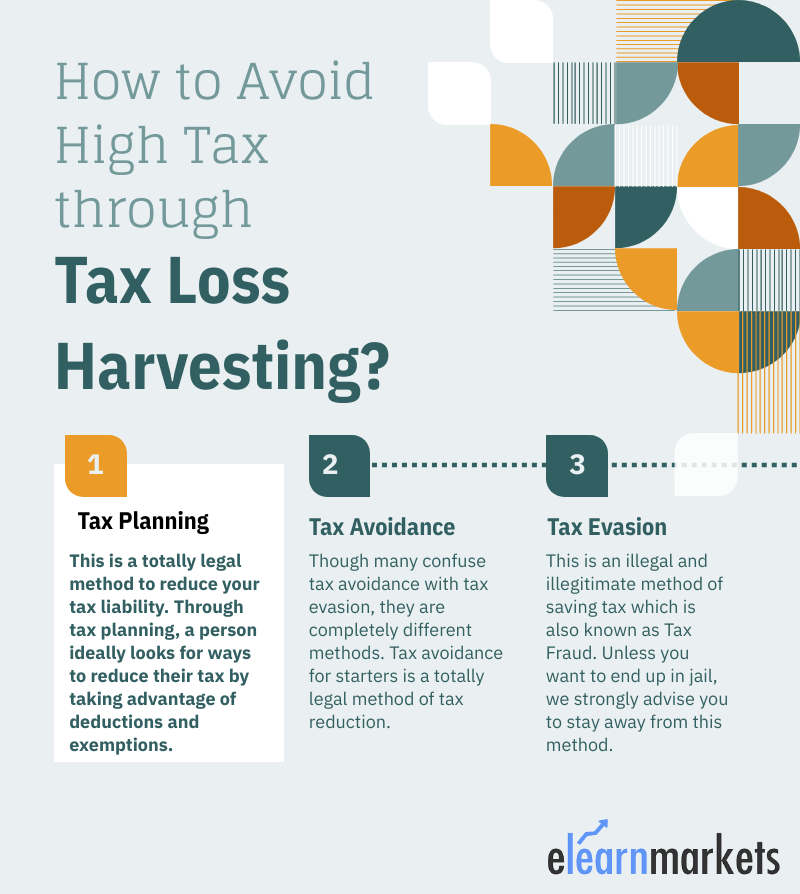

How To Avoid High Tax Through Tax Loss Harvesting? ELM

What is Tax Loss Harvesting?

What is TaxLoss Harvesting? Financial Planning ProVise

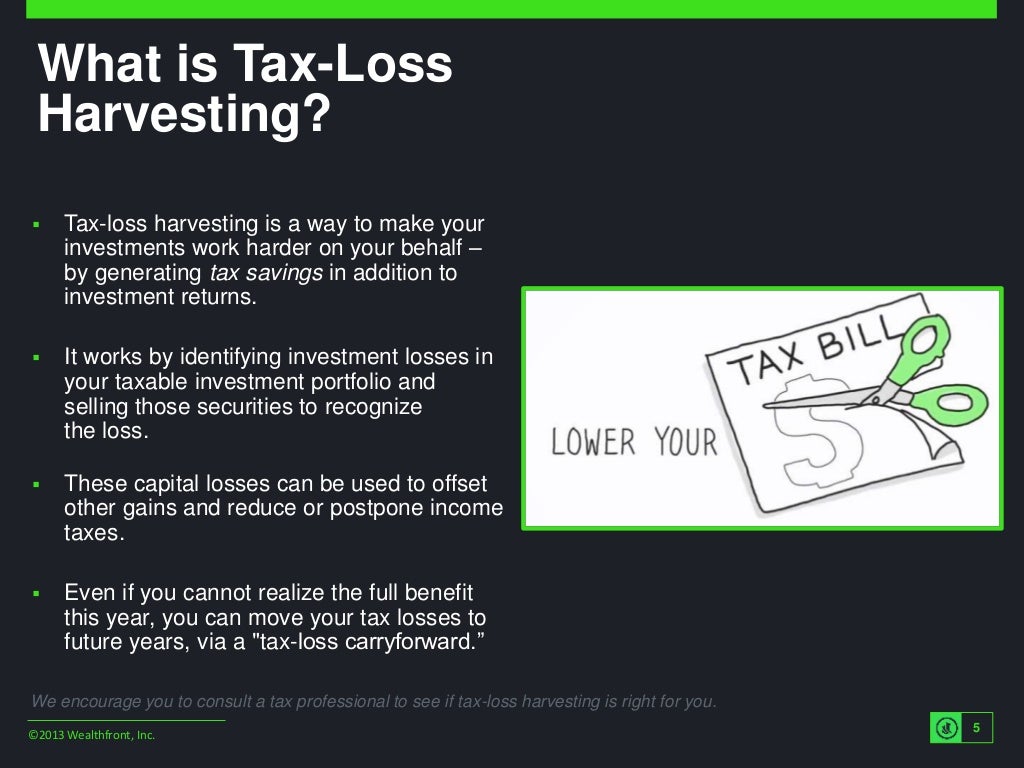

What is TaxLoss Harvesting? We

Tax Loss Harvesting A Silver Lining in Bear Markets Financial Symmetry, Inc.

Taxloss harvestingyearend 2018 John Hancock Investment Mgmt

Should You Use Tax Loss Harvesting?

Tax Loss Harvesting How to Benefit From Your Losses Caissa

What is Tax Loss Harvesting? A Guide to Automated TaxEfficient Investing

Tax Loss Harvesting with Vanguard A Step by Step Guide Physician on FIRE

TaxLoss Harvesting Rules and Examples of a YearRound Strategy Kindness Financial Planning

What is Tax Loss Harvesting?

Tax Loss Harvesting How to Benefit From Your Investment Losses

Tax Loss Harvesting Napkin Finance

TaxLoss Harvesting Rules and Examples of a YearRound Strategy Kindness Financial Planning

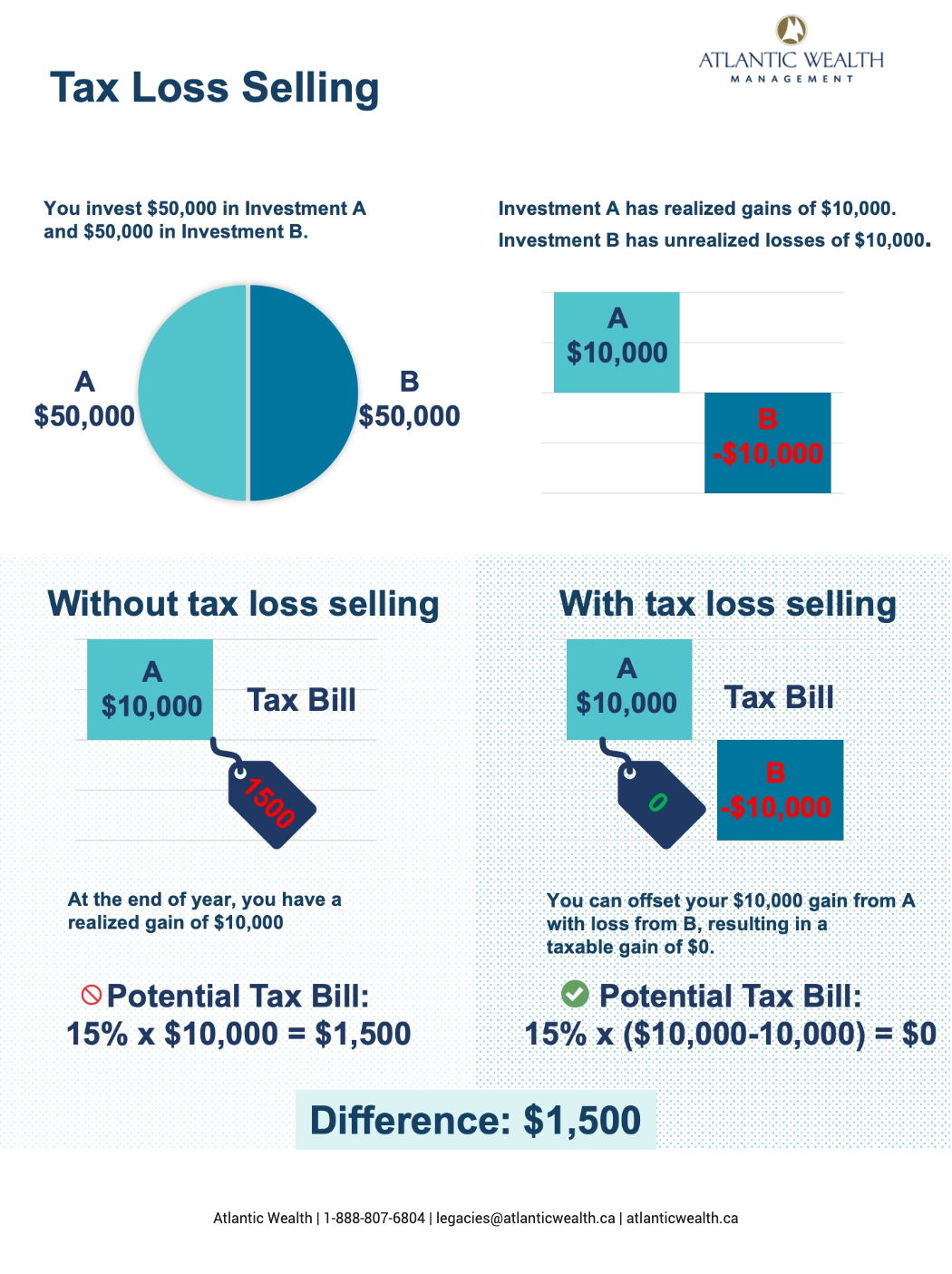

Tax Loss Selling Building Wealth. Protecting Legacies. Atlantic Wealth Management

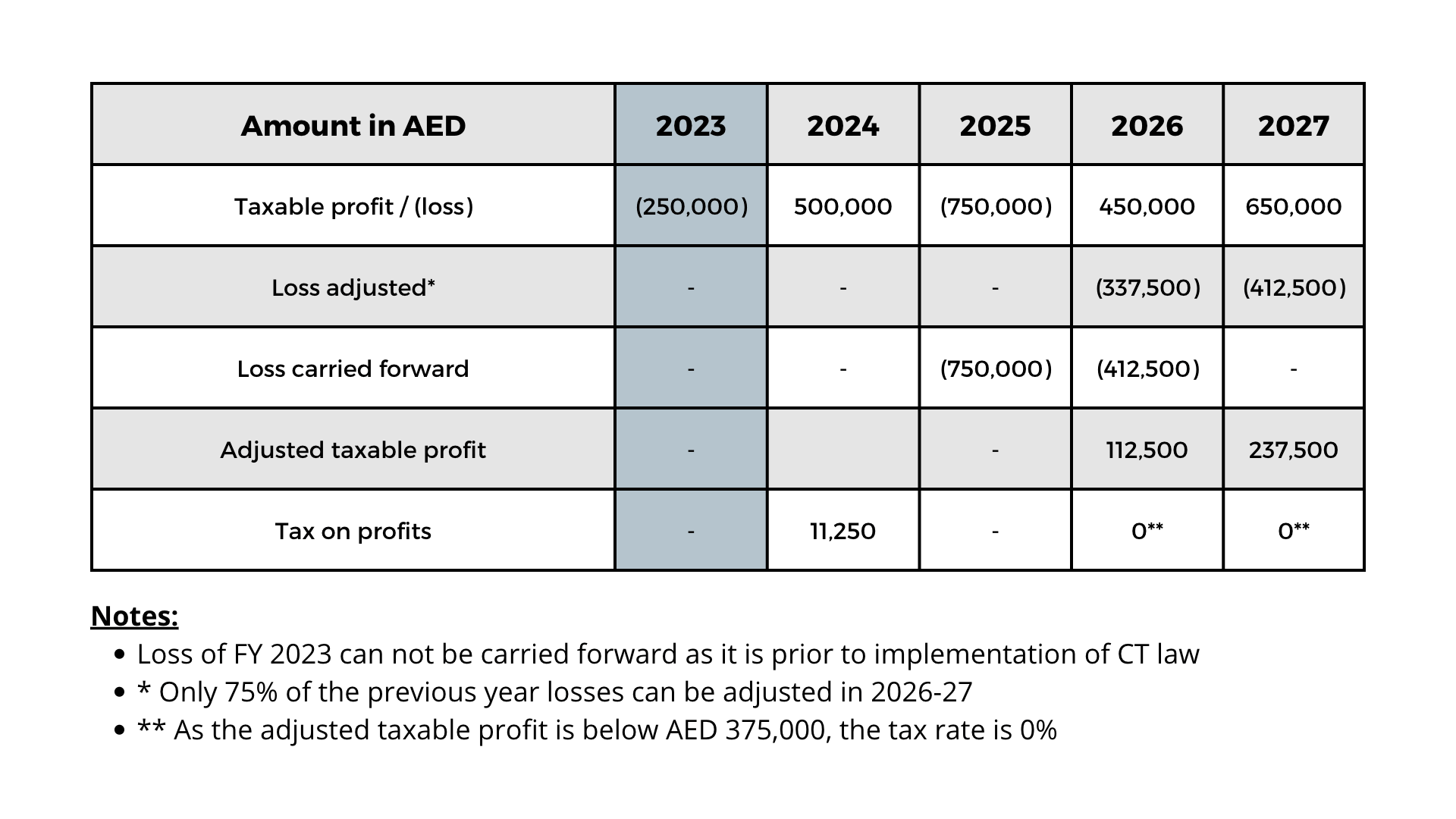

Corporate Tax Loss carry forward What, When and How much?

Tax Loss Harvesting Strategies used by Taxpayers to Offset Liabilities

What is Tax Loss Harvesting? Another intelligent way to save tax? MarketSecrets

The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries. Its broker-dealer subsidiary, Charles Schwab & Co. Inc. ( ), and its affiliates offer investment services and products. Its banking subsidiary, Charles Schwab Bank, SSB (member FDIC and an Equal Housing.. What is a Tax Loss? A tax loss occurs when total expenses are greater than total revenues under the tax reporting rules of the applicable government jurisdiction. A tax loss reduces an entity’s tax liability only in proportion to its tax bracket. Businesses and individuals will frequently reduce their reportable revenues or increase their reportable expenses for tax purposes in order to reduce.