Invest Hong Kong and PwC are pleased to present in-depth analysis of the ever-evolving role of digital in Hong Kong’s eCommerce, Food Services and Creative Industries.. Innovative companies are upgrading and updating traditional ways of working and doing business, triggering increased demand for digital media, tools and skills… For Hong Kong profits tax purposes, corporate residency is not relevant in determining the taxability of an entity except in a tax treaty context. Under the domestic tax law of Hong Kong SAR, the decisive factors for taxability are (i) whether a corporation is carrying on a trade, profession, or business in Hong Kong SAR, (ii) whether profits.

Doing Business in Hong Kong Chandrawat & Partners

How to Start a Business in Hong Kong in 2023 The Entrepreneurs’ Guide

An Introduction to Doing Business in Hong Kong 2021

PwC’s Hong Kong Office Accepts Bitcoin Payment Coinfeeds

DOING BUSINESS IN HONG KONG WEBINAR PECC

PwC Office Photos

Etiquette tips for doing business in Hong Kong Discovery

PwC Hong Kong collaborates with Loopring Foundation

What Are the Benefits of Doing Business in Hong Kong?

6 Benefits Of Doing Business In Hong Kong

Advantages of Doing Business in Hong Kong Corporate Hub Hong Kong

What Is The Most Profitable Business In Hong Kong?

Doing Business in Hong Kong Leader Corporate Services Limited Hong Kong

Doing business in Hong Kong 2022 YouTube

Contact us Careers PwC HK

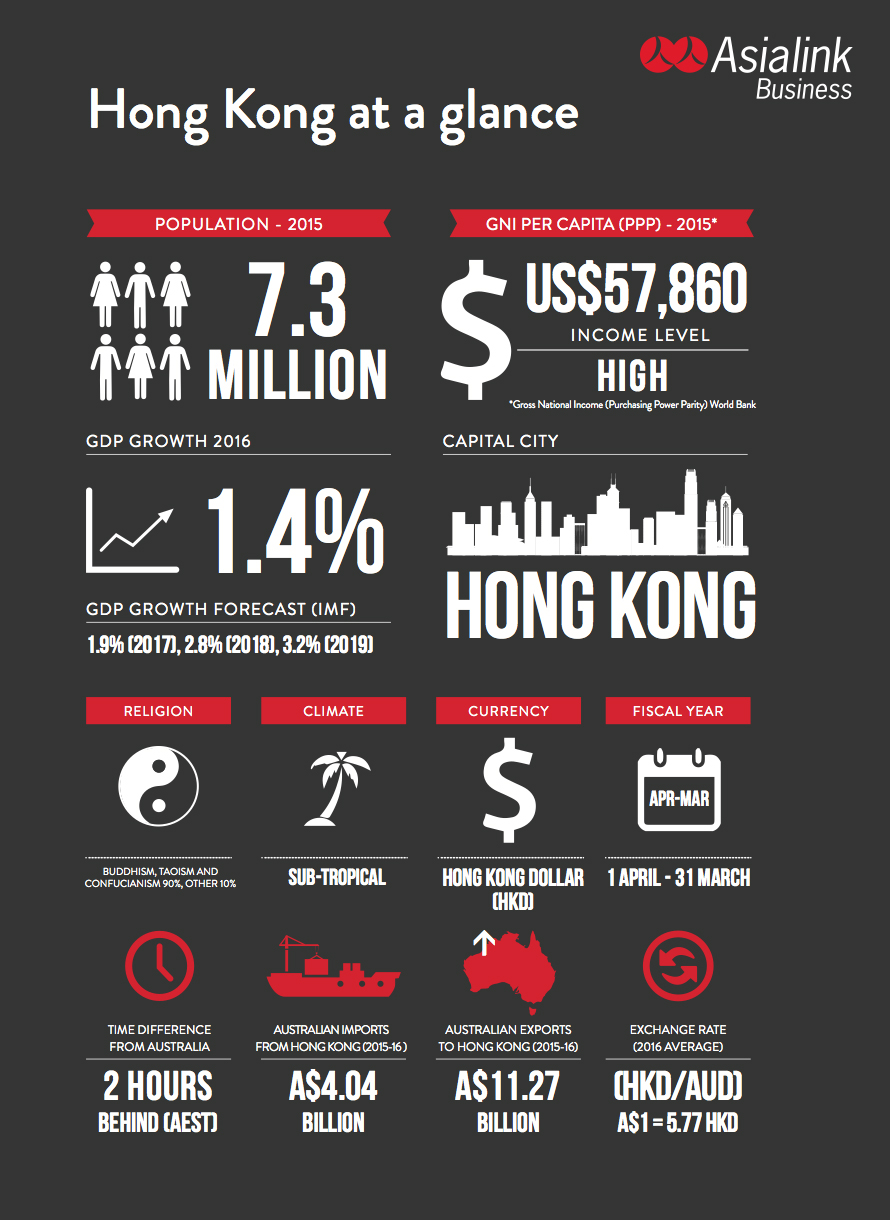

Doing Business in Hong Kong Asialink Business

Doing Business in Hong Kong

PwC CN PwC’s market share of listed companies in Hong Kong

Hong Kong Doing Business in Hong Kong 2020 Global Compliance News

An Introduction to Doing Business in Hong Kong 2021

Budget at a glance. Estimated consolidated deficit of HK$139.8bn for 2022/23 and forecast consolidated deficit HK$54.4bn for 2023/24. A series of campaigns including ‘ Hello Hong Kong ‘ and ‘ Happy Hong Kong ‘ for attracting overseas visitors and general public to support people and enterprises, and boost the momentum of our economic.. February 2024. The New Inspection Regime of the Companies Register (‘NIR’) under the Hong Kong Companies Ordinance (Cap. 622), has been fully implemented in three phases to enhance protection of personal data of directors and other individuals who appear on the Companies Register maintained by the Companies Registry (‘CR’). March 2023.