The Customs procedure involved can be divided into the following: Case 1 Passengers’ accompanying belongings which are not for commercial purpose and do not exceed 200,000 baht in value. Procedure. Customs officers at the “Goods to Declare” channel assess flat rate duty and taxes. Passengers make payment of duty and taxes by cash or debit.. Duty Free. Thailand customs allows visitors to enter Thailand with personal effects, the value of which does not exceed 80,000 Baht, without paying import fees as long as: 1) the items are specifically for personal or professional use; 2) the amount of goods are reasonable; and 3) the items are not subject to restriction or prohibition.

Thailand tax for digital nomads and remote workers Localise Asia

Bangkok NOV 22,2018 King Power Duty Free Shop at Don Mueang Airport, Bangkok of Thailand,it

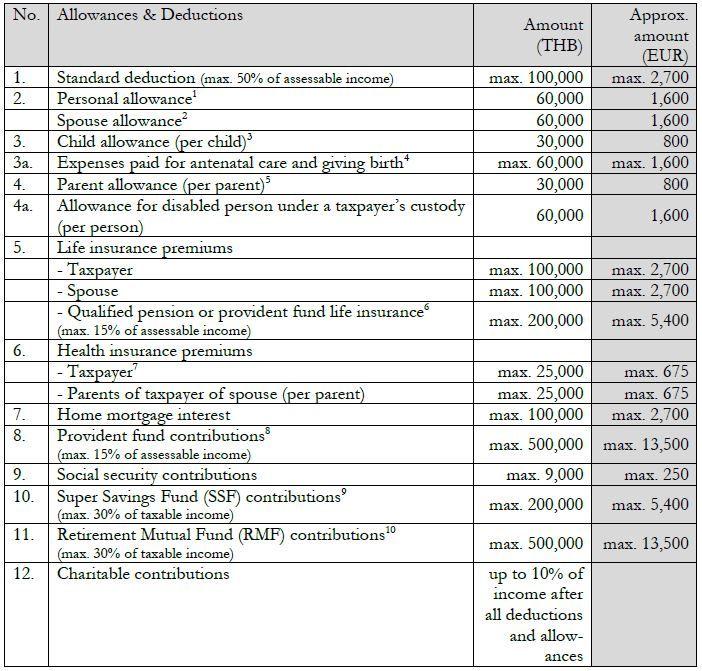

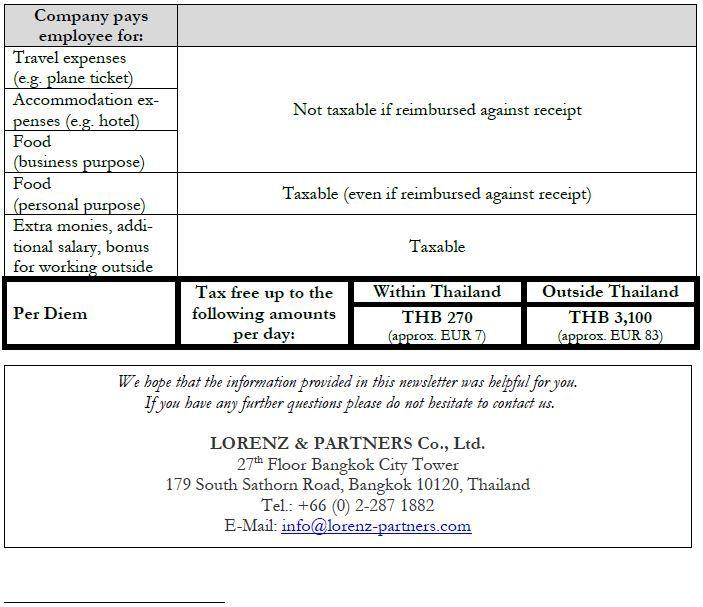

Taxdeductible Allowances in Thailand

PM orders review of duty free concession bidding process Thai PBS World The latest Thai news

King Power Duty Free Privileges, Bangkok, Thailand

Duty Free Allowances Stena Line YouTube

Taxdeductible Allowances in Thailand Lorenz & Partners

DutyFree Allowances in the EC, 1991 s Download Table

New duty free allowance scheme explained Ceylon Qk News

Duty free shopping Bangkok Interntational Airport Thailand Stock Photo Alamy

A Guide to Import Duties in Thailand DHL Express MY

King Power Duty Free Privileges, Bangkok, Thailand

Duty Free DFDS

King Power Duty Free In Thailand Editorial Photo 43277025

Duty Free Allowances Japan Tax Free Travel Travel Brain

Thailand, Bangkok, Suwannaphum airport, Duty Free shop Stock Photo Alamy

Ten Things You Need To Know About Duty Free All Aboard DFDS

Bangkok, Thailand May 12, 2019 Exterior View of a Duty Free Souvenir Store at Don Muang

Sri Lanka citizens given extra duty free baggage on inward remittances EconomyNext

Bangkok, Thailand, Asia, Duty free shop at Suvarnabhumi Airport Stock Photo Alamy

The duty-free allowance for goods brought into the US varies, but generally, you can bring back up to $800 worth of goods without paying duties. However, specific rules and exceptions apply. What is the car rule in Thailand? Thailand has regulations governing the import and use of cars, including emissions standards and safety requirements.. Learn about customs regulations before traveling to Thailand in 2024: import regulations, duty-free allowance, prohibited and restricted items.. Duty-free allowance Bringing alcohol. Restricted to travellers 20 years and over; 1 litre of alcohol.. The following are goods which cannot be brought into the country. Obscene media such as.